|

|

|

Money and

Understanding |

How Thinking Affects Investing (July 7, 2012) As investors, our goal is to make money. To do so, we buy assets that we hope will, one day, sell for more than we paid for them. Doing this with stocks or options is not easy, because the market in which we work is both complicated and unforgiving. The best investment decisions happen when we acquire pertinent information, evaluate it logically, and then act rationally. Over the years, however, I have come to the conclusion that the most frustrating aspect of being an investor is that we invariably accumulate knowledge a lot faster than we accumulate wisdom. As such, all of us find ourselves making financial mistakes — sometimes, important financial mistakes — because we have, unconsciously, abandoned rational thinking for emotion and intuition. A writer of economics like myself is privileged by his position to look down upon the mass of investors — analyzing and commenting upon their weaknesses and irrationalities. And yet, when I take the time to examine my own investment patterns, I must admit that, when it comes to buying and selling, I too suffer from many of the same weaknesses and irrationalities I see in others. The branch of economics that studies such concerns is called BEHAVIORAL ECONOMICS. In this essay, I am going to introduce you to the most practical concepts of behavioral economics. Along the way, I will describe the ubiquitous habits and biases that influence us unconsciously (usually for the worse). Specifically, we will be discussing what are called heuristics and cognitive biases: powerful patterns of thinking that can lead us astray without our being aware of what is happening. For each of these thinking patterns, I will explain how it affects our decision-making, and what you can do to mitigate its negative effects. At the end of the essay, I will summarize what we have learned and suggest strategies you can follow to rise above your limitations and improve your long-term investing results.

As a general rule, most of us are poor investors. This is because we often make decisions so as to minimize emotional discomfort. As such, we depend too much on our feelings and our intuition when, instead, it would serve us better to cultivate the skills of dispassionate appraisal and rational thinking. Why should this be the case? The answer has to do with how we think about most things most of the time. It is the nature of being human that we are called upon to make innumerable judgments, minute after minute, day after day. To do so, we depend on what psychologists call HEURISTICS: mental shortcuts that underlie our decision-making processes. Some heuristics are innate, hard-wired into our brain when we are born. Others are based on our experience and are learned as we mature. We use heuristics many times a day, unconsciously and automatically, whenever we need to solve a problem, understand something, or make a decision. Doing so enables us to make good decisions quickly, often with minimal information. For example, early one morning you are jogging along a narrow sidewalk and you see someone walking towards you. Without thinking, you move to the right, so the two of you can pass one another uneventfully. This is a heuristic. Later that day, during lunch, someone serves you some fruit, which you notice is covered with a greenish-blue mold and smells funny. You decline to eat it. This, too, is a heuristic. That night, as you are driving home from work, you notice you need gas. You drive to a corner where there are two gas stations. As you approach the corner, you quickly look at the signs and drive into the station with the least expensive gas. You are following a third heuristic. Heuristics enable us to pass through life smoothly and quickly, from one moment to the next, without having to stop and think deliberately about every action, every judgment, and every decision. Obviously, such quick, automatic actions are helpful, even crucial to our lives and to our well-being. However, heuristics are often imperfect and sometimes irrational. Moreover, because we apply them automatically, it is easy to make poor decisions without being consciously aware of what we are doing. Along with heuristics, we are influenced a great deal by what psychologists call COGNITIVE BIASES: distorted patterns of irrational thinking that lead to poor judgment. Where heuristics are often useful to our lives, cognitive biases are almost always harmful in some way, as they blind us to the reality of the problem at hand. The combination of heuristics and cognitive biases is particularly powerful when it comes to thinking about money, especially when we are investing. For example, consider the following question: You own 100 shares of a stock that has gone up a fair bit since you bought it. Lately, however, the price has gone down. How do you decide when it is time to sell? Knowing when to sell a stock requires you to guess what is going to happen. If you think the value of the stock will go down, you will sell now. If you think the value of the stock will go up, you will wait to sell. Since you don't know for sure, however, it is likely that you will fall back on one or more heuristics and cogitative biases to make your decision. Moreover, as you do so, you won't even be aware of what you are thinking or why. Much of the investing I do involves selling short-term options based on one particular stock that is especially volatile. This work requires me to watch the stock's price very carefully, often from minute to minute. As such, I can tell you categorically that stock prices are notoriously unpredictable. Sometimes they will cruise along quietly for hours, or even a few days, with only minor movement. Every now and then, however, at unpredictable intervals, there will be significant changes within a short time, sometimes within a few seconds. Nevertheless, it is important to me and the people I work with to anticipate the short- term price changes as best we can. Since no one can predict the future, this often tempts us to make decisions based on an intuitive feeling. If we guess right and we do our job skillfully, we make money. If not, we lose money (and, in the option-selling business, it is possible to lose a lot of money quickly). Intuitive feelings notwithstanding, when I trade, it is important to me to be as rational and unemotional as possible. This only makes sense: the market itself is unemotional, if not rational. For this reason, I have spent a lot of time thinking about the heuristics and cognitive biases that color my thinking, so I can eliminate them as much as possible. I would now like to share my thoughts and my advice with you.

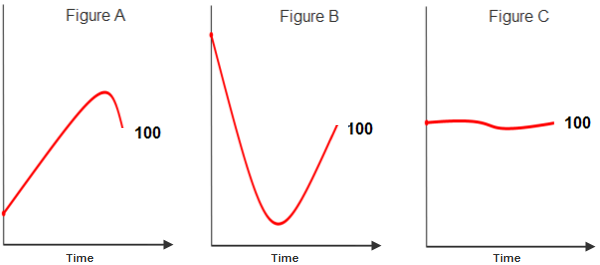

The world we live in is, in large part, physical. The stock market, of course, is completely abstract. Thus, when we assume, unconsciously, that the market follows the familiar laws of physics, it leads only to confusion and losses. In my experience, one of the biggest mistakes we make is to look at a graph of stock prices and assume that it can help us predict what is about to happen. To see what I mean, I want you to take a look at the three graphs in the figures below and then think about a particular question. |

|

|

Each of these three curves traces the value of a stock over the same interval of time. Although each stock follows a different path, they all end up with a value of $100/share at the same time. However, the route they follow to get to this price differs considerably. The question I want you to consider is: What will happen next to each of the stocks? The stock shown in Figure A started with a low value. It climbed quickly, peaked, and then descended to $100. The stock in Figure B started high, fell sharply, and then recovered to climb up to $100. The stock in Figure C started at $100 and stayed pretty much the same the entire time. If we follow our intuitive heuristics (which work well in the physical world), we will interpret the price curves as being subject to momentum and gravity. Thus, it is easy to conclude that, in the near future, stock A is likely to continue to go lower, stock B will continue to go higher, and stock C will stay about the same. This, however, is not the case. I have seen these patterns many times, and I can tell you categorically, they indicate nothing about what is going to happen next. Unlike the physical world, the inhabitants of the stock market are not subject to physical laws. Indeed, in the short term, prices have so much randomness that making judgments by looking at graphs and following your intuition is a highly dependable way to lose money. Harley's Rule of Investing #1: Your intuition cannot predict what a stock will do.

In general, one of the best ways to predict what is likely to happen in life is to ask yourself what happened before under similar circumstances? For example, when we press on the brake, our car slows down; when we press on the accelerator, the car speeds up. The tendency to assume that similar circumstances will lead to similar outcomes is an important heuristic, one that is particularly useful because many of the details of day-to-day life are highly predictable. Using our past experiences to predict the future enables us to take care of ourselves and to keep ourselves safe. The prediction heuristic is surprisingly powerful when it comes to understanding other people. For instance, if you want to predict what someone you know will do in a specific situation, all you have to do is remember how they responded in similar situations. For example, let's say that each time you forget your anniversary, your spouse gets upset and pouts. What do you think will happen if you forget it again? Because we are human, it is easy to assume that the stock market is influenced by predictable forces, capable of acting in ways that are familiar to us. The market, however, is not at all like the day-to-day world; nor does it experience human emotions or have a personality. When we apply this type of thinking to the stock market, the valuable prediction heuristic quickly leads us astray and becomes a dangerous cognitive bias, which we call REPRESENTATION BIAS. The truth is, whatever happened in the past to the price of a stock does not indicate what is likely to happen in the future. No matter how similar the current circumstances seem to resemble patterns we think we remember, the belief that we can use the past to predict the future is nothing more than representation bias, and will almost always let us down with a thud. Harley's Rule of Investing #2: When you are investing, the past does not predict the future.

Let's say you are in a situation where you must choose one of the following: you can either avoid losing $1,000, or you can gain $1,000. Logically, these two choices are equivalent, so it shouldn't matter which one you pick. Nevertheless, because of a cognitive bias we call LOSS AVERSION, most people tend to select the first choice. Why? Because, for most human beings, the satisfaction that comes from avoiding a loss is much stronger than the satisfaction that comes from acquiring a similar gain. The fact is, every successful investor will have times when he or she is faced with the need to accept a loss and move on. The decision should be made rationally, without emotion and without unnecessary delay. This is why loss aversion causes us so much trouble. Because we suffer disproportionately from losses, the fear of a loss has more power over our behavior than does the prospect of a gain. As a result, we often find ourselves maneuvering to avoid the internal discomfort that comes with a loss even when what we are doing is, rationally, not in our best interest. Moreover, because this all happens beyond our conscious awareness, we invariably fool ourselves into thinking we are making the best possible decisions, when we are actually acting irrationally. As an investor, you can expect loss aversion to manifest itself in three important ways, each of which is a cognitive bias in its own right:

My goal is to help you become aware of these specific cognitive biases, and to show you how to avoid them when you make investment decisions. In the long run, such insight into your emotional nature will pay off handsomely. Harley's Rule of Investing #3: The most expensive tuition is what you end up paying the market to teach you how to take a loss.

The ENDOWMENT AFFECT, sometimes called OWNERSHIP BIAS, dictates that when we own something, we place a higher value on it than if we would if didn't own it. It is the endowment effect that is, in large part, responsible for so many of the useless objects that clutter people's homes. Once we own something, it can be difficult to throw it out or give it away, even if we don't really need it. (How much easier it is to not acquire such objects in the first place!) On the other hand, it is easy to go through someone else's belongings and point out all the unnecessary junk. The endowment effect is particularly strong when we buy and sell stocks. Consider the following example. Person A owns $1,000 worth of stock in the XYZ Company. Person B has no stock, but he has $1,000 in cash. Person A and Person B discuss the merits of XYZ and come to the conclusion, together, that, right now, holding stock in the company would be a bad investment. There are better ways for each of them to use $1,000. If you are Person B, you, will find it easy to not use your $1,000 to buy XYZ stock. After all, you have just decided it is a poor investment. If you are Person A, however, you will find it much more difficult to sell your $1,000 worth of stock. Why? Because you already own the stock. Because of the endowment effect, the stocks you own seem more valuable than they would if you didn't own them, which makes them all the more difficult to sell. Harley's Rule of Investing #4: The stock doesn't care who owns it.

A second cognitive bias caused by loss aversion is the DISPOSITION EFFECT: the tendency to wait too long to take losses or to move too quickly to realize gains. Because most of us tend to be loss averse, we will often hold onto a stock that has decreased in value long past the time when it would have made sense to sell. By hanging onto the stock and hoping it will go back up, we are able to avoid the regret that comes from acknowledging that the loss is permanent. Conversely, when we are fortunate enough to have one of our stocks go up quickly, loss aversion will often induce us to sell the stock too soon. Why? Because selling a stock that has gone up in value — even when it makes sense to keep holding it — locks in our gain, which is one way to deal with the fear that a sudden drop in price will turn a winner into a loser Over the long term, the disposition effect is responsible for a great deal of lost profit: instead of buying and selling rationally, we end up holding on to losers and selling our winners. A more rational strategy is to perform a regular assessment, during which we set aside our feelings and take a frank look at our investment portfolio. At that time, we can evaluate each stock and — regardless of the history of the stock's price — ask the question: Right now, is this stock worth owning? This allows us to identify the stocks we should not own any longer, so we can sell them and invest the money in holdings with more growth potential. Because of the disposition effect, however, making such impersonal decisions can be difficult. If you study investors who have long-term success, you will see that they have learned how to overcome the disposition effect. This enables them to jettison losers as quickly as possible, and keep winners long enough to develop to their full potential. To make it easier for yourself, when the time comes to evaluate your holdings, I suggest that you remember the following principle. Harley's Rule of Investing #5: Ignore what you feel; buy and sell when it makes sense to do so.

When you spend money that cannot be recovered, economists refer to it as a SUNK COST. For example, let's say a company budgets $100,000 to develop new software for internal use. After three months, they have spent $25,000. The $25,000 is a sunk cost, because it can never be recovered. As a general rule, it is best to ignore sunk costs when you make investment decisions. What's done is done: changing the future can't change the past. Nevertheless, it is common for investors to be influenced by sunk costs, a cognitive bias referred to as the SUNK-COST EFFECT. Being aware of the sunk-cost effect can save you a lot of money. In the example above, let's say that, after three months, the managers of the company developing the software realize that it will never actually do what they need. However, they choose to maintain the project because they have already "invested" $25,000. This is the sunk-cost effect. (A sadder example would be an engaged couple with serious misgivings, who agree to go through with their marriage because they have already spent a lot of non-refundable money on the wedding.) As an investor, sunk costs should never influence your decisions. When you see a loss, do your best to re-focus on your goal and make the best decision you can, assessing the situation as rationally as possible on its own merits. Example: You have spent $10,000 on Stock A, which then drops in price to $7,000. However, you believe that you can make more money by selling Stock A and buying Stock B. Since your goal as an investor is to make as much money as possible, the best decision is to make the change, even though it means acknowledging a sunk cost of $3,000. Harley's Rule of Investing #6: Once money is gone, you can't get it back — so don't try.

It is common to find ourselves relying on only one specific item of information when making a decision. In such cases, the information is called an ANCHOR. The tendency to rely too much on an anchor, and thereby make an irrational decision, is a cognitive bias we call ANCHORING. For example, let's say that a month ago you were thinking of buying a particular stock that was selling for $150/share. However, you decided to wait. Since then, the stock has declined to $100/share. If you use the previous price of $150 as a reference point (an anchor), the current price looks like a bargain. However, if you depend only on a price comparison, you are neglecting to answer the real question: If you buy the stock at $100/share, is it likely to be a profitable investment? The moment we buy a stock, the price becomes an important number. After all, what we paid will ultimately determine how much money we will make or lose on the investment. However, if we let the purchase price become an anchor, it will influence our decision making, and predispose us to the disposition effect we discussed earlier: the tendency to wait too long to take losses and to move too quickly to realize gains. Anchoring leads to distorted thinking because our emotions and our intuition make it easy to use the anchor as a reference point. Instead, we would be better off making a more logical analysis, independent of previous costs or gains. No one can guess perfectly and, over time, every investor learns that not all of his investments are going to make money. From time to time, it is important to be able to recognize a loss, close out the investment, and move on. If you can make more money selling a stock than keeping it, you should sell it, regardless of how much money you paid for it. There is no reason to consider what you paid for something, when you are trying to decide whether or not to keep it. Let me embody this guideline in the form of a rule: Harley's Rule of Investing #7: The stock doesn't care what you paid for it.

Have you ever noticed that people tend to remember and interpret information in a way that confirms what they already believe? This is a very important cognitive bias known by several names, most commonly, CONFIRMATION BIAS. The most important characteristic of confirmation bias is that — as odd as it sounds — the stronger the belief, the stronger the bias. This is why, in public discourse, the most highly charged topics (for example, gun control, abortion, global warming) stimulate the most biased opinions and actions. Why does confirmation bias exist? It is not the case that human beings are biased towards confirming what they already believe, because they are unwilling to look at any evidence to the contrary. The actual explanation answer is more subtle. The truth is, most people are willing to listen to opinions different from their own. (This is why there are so many arguments.) However, during such arguments, people tend to listen in a one-sided way, focusing only on the evidence that supports their point of view, while ignoring alternatives that might prove them wrong. Thus, confirmation bias is caused, not by ignorance, but by poor listening skills. Confirmation bias is so common and so powerful that, as in investor, it can severely limit your ability to make independent, rational decisions. As such, you must come to terms with it. Specifically, you should train yourself to recognize confirmation bias in your thinking and — once you recognize it — to force yourself to consider alternatives. The easiest way to overcome confirmation bias is to deliberately seek out opinions and information that differ from what you want to hear. In practice, there are two good ways to do this. First, before you make any important financial decision, find a strong-willed, knowledgeable person who is willing to listen to your ideas and argue against you. Alternatively, if you have enough maturity, you can force yourself to be a devil's advocate and do your best to pick apart your own opinions, trying to see if you can prove yourself wrong. As an example, let's say you have done a lot of research and have identified a stock you think is undervalued. The stock, you believe, has a good chance of going up over the next few years. Before you invest, see if you can find a smart, knowledgeable person who likes to argue. Present your findings to him or her, set aside your ego, and invite that person to point out your mistakes. (This, in a nutshell, is what scientists must do before their ideas will be accepted by other scientists.) There is no doubt that arguing with such a person can be frustrating. Moreover, if he or she succeeds in finding significant flaws in your research or your reasoning, you will probably feel foolish and embarrassed. However, feeling foolish and embarrassed is a lot more pleasant than what you will feel if you lose a lot of money, because a bias you didn't even know you had kept you from thinking well. Harley's Rule of Investing #8: The market doesn't care what you believe.

It is a fundamental characteristic of human beings that we are able to hold two conflicting ideas in our mind at the same time. For example, we can both like and dislike a particular person; we can both support and not support a specific social cause. The ability to maintain contradictions in our thinking creates a valuable mental richness that would not be possible if we were able to see the world only in discrete, black and white terms. However, when we find ourselves under the influence of contradictory ideas that relate to our beliefs or our desires, we experience significant mental discomfort. The psychological term for this discomfort is COGNITIVE DISSONANCE. Cognitive dissonance is most pronounced when our actions do not match our beliefs. For instance, consider an overweight person who wants to lose weight, and who believes it is unhealthy to indulge in refined carbohydrates and sugar. From time to time, he may, nevertheless, find himself chowing down on pizza and chocolate cake. In such cases, something inside him will need to change in order to relieve the unpleasant feeling produced by the harsh inconsistency (the dissonance) between his actions and his beliefs. In this case, the person will most likely modify his thinking, at least temporarily, to make himself feel better. He might, for example, justify his indulgence by telling himself that eating pizza and cake is a treat, and everyone deserves a treat once in a while. Rationalizations like this usually serve their purpose, in that they reduce the internal discomfort created by the cognitive dissonance. However, in the long run, such strategies are merely temporary solutions to a permanent problem. As such, they cause more harm than good. When we invest, it is common to encounter significant cognitive dissonance in the form of misgivings. Most often this happens after we have made an important decision and, later, we encounter information that leads us to think that our decision may not work out as well as we have hoped. In such cases, we must resist the temptation to reduce our discomfort by ignoring or discrediting the new information. Instead, we are better served by asking ourselves if we ought to reevaluate our decision. If so, we must do so dispassionately, without bias. Harley's Rule of Investing #9: It is a lot easier to be honest with other people than it is to be honest with yourself.

To invest well requires us to predict the future. Strictly speaking, this is impossible because the stock market is inherently unpredictable. Nevertheless, over the long run, it is possible to make money, if we can fulfill all of the following requirements:

1. We must know what we are doing.

As straightforward as this seems, it is difficult to do, because of natural limitations beyond our control, a concept economists refer to as BOUNDED RATIONALITY. Bounded rationality asserts that our potential to make the best-possible decisions is limited in three important ways: First, we are limited by the amount of information that is available to us. No matter how much knowledge we are able to acquire and understand, our information will always be incomplete. Second, we are limited by our ability to think well. No matter how smart we may be, and no matter how logical we try to be, we are still creatures of habit, emotion, and intuition. As such, we are susceptible to the problems created by the heuristics and cognitive biases. Thus, it is impossible for a human being to think comprehensively and rationally under all circumstances. Finally, we are limited in that every decision we are called upon to make must be carried out in a finite amount of time. Because of the limitations imposed by bounded rationality, there is a pattern of action that will tempt you: a trap I want to make sure you avoid. When you are faced with a complex and difficult situation, it is common to feel uncomfortable. This is normal. It is a warning that you do not have the information, the expertise, and the time to make an optimal decision. What many people do in such circumstances is to over-simplify the issues to the point where they can make a decision, even if it doesn't make sense. To do so, they will manipulate themselves and the people around them, unconsciously, so as to simplify the details and the possible choices they are facing. It is only then — after they have fooled themselves into thinking the situation is easy to understand — that they begin to apply logical thinking (with predictably negative results). As an example, it is common for companies that receive many applications for a job to use arbitrary criteria to narrow the field. For instance, a company with 200 applications for a single job might consider only those people whose resumes were no more than one page long. Although this is not a particularly good strategy, it does reduce the applicant pool quickly, making the job-hiring process a lot easier. Consider another example. An investor has a portfolio consisting of several hundred shares in each of 10 different stocks. He needs to sell some of the shares within the next week to pay his son's college tuition. Trying to figure out which stocks to sell, and how much, quickly overwhelms him. There is simply too much information for him to analyze in a week. However, a friend with business experience happens to mention that, in his experience, young CEOs often have trouble growing a company past a certain size. The investor checks each of the 10 companies and finds that three of them have CEOs younger than 50 years old. He then looks only at those three companies, focusing on which of the three stocks is the best one to sell. Being human, we will never escape the limits of bounded rationality. As a result, we must accept the idea that we will often be called upon to make investment decisions we can't fully understand. Nevertheless, in such situations, we must avoid the temptation to make decisions foolishly, just because doing so is easy. There are no simple solutions to the problems caused by bounded rationality. The best advice I can give you is to simplify only in a way that makes sense — and then respect your limitations. Harley's Rule of Investing #10: Sometimes good enough is good enough.

We have noted that to be a successful investor requires us to fulfill the following four requirements:

1. We must know what we are doing.

Most people, however, are poor investors because they make decisions primarily to avoid emotional discomfort. This is because their thinking patterns are unconsciously influenced by heuristics and cognitive biases. In this section, I am going to summarize the important ideas we have covered in this essay. I will then show you a simple way to apply this knowledge to become a successful, rational investor. HEURISTICS are mental shortcuts that underlie our decision-making processes. We use heuristics many times a day to help us make good decisions quickly, often with minimal information. However, when we apply heuristics to the stock market — which is much different from everyday life — they often lead us astray. COGNITIVE BIASES are powerful patterns of thinking, mostly irrational, that tend to always lead us astray. In both cases, we are generally not aware that we are applying heuristics or cognitive biases to our decision making, which means it is difficult to recognize and correct the source of poor results. Here is a summary of the heuristics and cognitive biases, along with the Rules of Investing you and I have discussed in this essay. 1. False Analogies to the Physical World Interpreting investment information, such as graphs, as if they were describing phenomena in the physical world. This leads us to assume that stock prices act as if they are following the laws of gravity and inertia. Harley's Rule of Investing #1: Your intuition cannot predict what a stock will do. 2. Representation Bias Assuming that similar circumstances will lead to similar outcomes. This leads us to assume that the past can predict the future. Harley's Rule of Investing #2: When you are investing, the past does not predict the future. 3. Loss Aversion Experiencing more satisfaction from avoiding a loss than from acquiring a similar gain. This leads us to make decisions because of the fear that we will suffer emotionally if we sustain a loss. Harley's Rule of Investing #3: The most expensive tuition is what you end up paying the market to teach you how to take a loss. 4. Endowment Affect Placing a higher value on something we own, compared to how we would value it if we didn't own it. This makes it difficult for us to sell our holdings, even when it is in our best interests to do so. Harley's Rule of Investing #4: The stock doesn't care who owns it. 5. Disposition Effect Waiting too long to take losses or to moving too quickly to realize gains. Over time, this causes us to increase our losses and decrease our gains. Harley's Rule of Investing #5: Ignore what you feel; buy and sell when it makes sense. 6. Sunk-cost Effect Refusing to acknowledge that money that can never be recovered is gone forever. This makes it difficult to abandon a misguided plan, when we have already spent money on it. Harley's Rule of Investing #6: Once money is gone, you can't get it back — so don't try. 7. Anchoring Relying on only one specific item of information (an anchor) when making a decision, for example, the price that we paid to acquire a stock. Anchoring makes it difficult to analyze a situation logically, independent of previous costs or gains. Harley's Rule of Investing #7: The stock doesn't care what you paid for it. 8. Confirmation Bias Remembering and interpreting information in a way that tends to confirm what we already believe. This severely limits our ability to make independent, rational decisions. Harley's Rule of Investing #8: The market doesn't care what you believe. 9. Cognitive Dissonance The mental discomfort caused by holding multiple contradictory ideas related to a belief or a desire. This discomfort is especially pronounced when our actions do not match our beliefs. Cognitive dissonance often occurs when we encounter information that indicates that a previous decision may not work out as well as we had hoped. This leads us to reduce our discomfort by ignoring or discrediting the new information. Harley's Rule of Investing #9: It is a lot easier to be honest with other people than it is to be honest with yourself. 10. Bounded Rationality The realization that our potential to make the best possible choices will always be limited by our information, our ability to think rationally, and the finite time we have to make decisions. Harley's Rule of Investing #10: Sometimes good enough is good enough.

To be a good investor, you must, over time, acquire skill and knowledge. To become a successful investor, however, requires more. You must be able to make good decisions consistently, month after month after month. Like a pilot who learns how to depend on his instruments, you must train yourself to think clearly and logically at all times. This requires you to base your financial decisions on rational thinking, not on your feelings or intuition. The easiest way I know to develop these habits is to apply your knowledge of heuristics and cognitive biases every time you find yourself making a financial decision. Eventually, this will eliminate distortions from your decision making, at which point thinking clearly about your investment activities will become second nature. Here is how to do it. Whenever you find yourself making a financial decision, no matter how small, go through the following checklist, one item at a time. List of heuristics and cognitive biases

For each item, recall the nature of the bias. (To remind yourself of the details, simply refer to the summary in the previous section.) Then ask yourself: "Right now, is this particular bias affecting my decision making?" If you are honest, you will often realize that your thoughts are distorted. When this happens, simply revise your ideas, and try again. I promise you, once you can get through the entire checklist, and you honestly feel confident that none of the biases are affecting your thinking at that moment, you will be happy with your decision. Eventually, as you train yourself to avoid the cognitive biases that plague financial decision-making, you will find that, more and more, you are able to think carefully and act prudently, especially under pressure. When that day comes, you will be a successful, confident investor.

The recipe for long-term success can be summed up simply:

These three guidelines are the foundation of all successful, long-term investment strategies. As such, I am sure they make a great deal of sense to you. However, there is more. Being a good investor requires more than becoming proficient at trading stocks and managing money. You must also develop a sense of humility. As you do so, you will slowly learn about yourself, your thinking habits, and your unconscious motivations. In the long run, these insights are crucial to your overall success, as they enable you to master your emotions, particularly fear and greed. The stock market is a complex and uncaring place, and it is up to you to look after your own interests. You must learn to respect the strong, impersonal forces that can affect you without warning. This requires an honest, realistic understanding of your personal shortcomings, as well as the limitations placed upon you by your environment. This idea is so important that I will embody it as one last rule. — Harley's Fundamental Rule of Investing — The market doesn't care whether or not you make money.

© All contents Copyright 2026, Harley Hahn

|