|

|

|

Money and

Understanding |

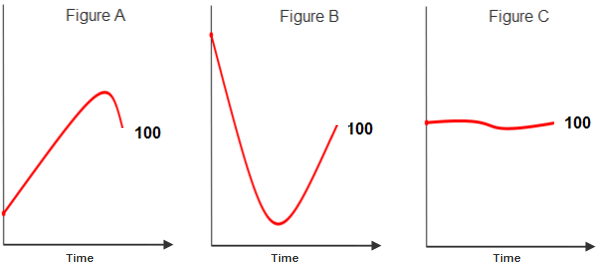

How Thinking

The world we live in is, in large part, physical. The stock market, of course, is completely abstract. Thus, when we assume, unconsciously, that the market follows the familiar laws of physics, it leads only to confusion and losses. This is called a FALSE ANALOGY TO THE PHYSICAL WORLD. In my experience, one of the biggest mistakes we make is to look at a graph of stock prices and assume that it can help us predict what is about to happen. To see what I mean, I want you to take a look at the three graphs in the figures below and then think about a particular question. Each of these three curves traces the value of a stock over the same interval of time. Although each stock follows a different path, they all end up with a value of $100/share at the same time. However, the route they follow to get to this price differs considerably. The question I want you to consider is: What will happen next to each of the stocks? |

|

|

The stock shown in Figure A started with a low value. It climbed quickly, peaked, and then descended to $100. The stock in Figure B started high, fell sharply, and then recovered to climb up to $100. The stock in Figure C started at $100 and stayed pretty much the same the entire time. If we follow our intuitive heuristics (which work well in the physical world), we will interpret the price curves as being subject to momentum and gravity. Thus, it is easy to conclude that, in the near future, stock A is likely to continue to go lower, stock B will continue to go higher, and stock C will stay about the same. This, however, is not the case. I have seen these patterns many times, and I can tell you categorically, they indicate nothing about what is going to happen next. Unlike the physical world, the inhabitants of the stock market are not subject to physical laws. Indeed, in the short term, prices have so much randomness that making judgments by looking at graphs and following your intuition is a highly dependable way to lose money. — Harley's Rule of Investing #1 — Your intuition cannot predict what a stock will do.

© All contents Copyright 2026, Harley Hahn

|